richmond property tax records

How to read your Property Tax Bill. If you fail to find the property you are looking for please try a less specific search for example when searching for a property owned by John Doe try searching by the last name only Doe.

3211 Nevin Avenue North East Richmond Ca Compass Wall Furnace House Prices Richmond

Tax Collector - Town of Richmond Maine.

. Certain Tax Records are considered public record which means they are available to the public while some Tax. This is the identifier of the property used by the Tax Assessor. To generate an equitable tax digest for the State of Georgia all levying authorities and the Tax Commissioner.

This is the unique number that is assigned to each taxpayer. Broad Street Richmond VA 23219. The information contained on this site was compiled from data available at the Richmond Township Assessors Office solely for the governmental purpose of property assessment.

It usually will appear on a tax bill or other correspondance from the Tax Assessor. The mission is to produce and certify an accurate and timely tax roll on an annual basis. The City Assessor determines the FMV of over 70000 real property parcels each year.

The results of a successful search will provide the user with information including assessment details land data service information planning and governmental specifics about the property. Property value 100000. Personal Property Registration Form An ANNUAL filing is required on all.

If you are contemplating moving there or just planning to invest in the citys property youll come to know whether the citys property tax rules work for you or youd rather look for a different locale. Assessed value of the property. Search results may be exported to a PDF an Excel Spreadsheet or a Word Document.

Each office is reflective of the North Carolina General Statues that administers property taxation in North Carolina. Payments cannot be taken at the tax commissioners tag offices. The Richmond County Tax Department consists of three departments that are responsible for providing customer service to the tax payers of Richmond County.

Payments can be made through the mail the tax commissioners website and at the Municipal Building. For more information call 706-821-2391. Visit our Property Inquiry application.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. The results of a successful search will include the outstanding tax penalty and interest owed for a property. Tax Records include property tax assessments property appraisals and income tax records.

Feel free to contact the office should you have any questions 804-333-3555. Real property is generally land and all the improvements. The tax year is July 1st through June 30th.

Public Property Records provide information on land homes and commercial properties in Richmond including titles property deeds mortgages property tax assessment records and other documents. This utility allows a person to interactively search for City of Richmond real estate tax information based on Parcel ID or Address. Taxpayers may not feel much relief however as the lower millage competes with their rising property values.

The Tax Administrator oversees the entire department to ensure that all tax. Property Taxes Due 2021 property tax bills were due as of November 15 2021. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council.

This information should not be relied upon by anyone as the final determination of ownership of property market value andor for any other purpose without verification of the information with. Personal Property Taxes are billed once a year with a December 5 th due date. Field checks occur throughout the year.

Should you have questions or desire to confirm the presence of field staff you may contact the property appraisal office at 706 821-1765. The Virginia Constitution requires that all assessments be at 100 of the fair market value FMV of the property. It must be entered exactly as it appears in the Tax Assessors records including dashes and slashes.

It must be entered exactly as it appears in the Tax Assessors records including dashes and slashes. Last updated November 30. The office is responsible for identifying listing and estimating the market value of all residential commercial and industrial property business and personal property and registered motor vehicles within the town in a manner specified by law.

Search by Parcel ID. Around September 1st based on the assessment as of April 1st of that year and tax bills are sent to the owner of record as of April 1st. The City Assessor is responsible for listing and keeping the records for all real and personal property in the City of Richmond.

This is the identifier of the property used by the Tax Assessor. For Personal Property direct your call to the Assistant Deputy of Personal Property. If available in the property information you can also search by Intrument Number and Subdivision name.

Richmond County school board enacts tax hike with record-low millage. Order Tax Certificates Tax Certificates are conveniently available online through. MapLot 16-17 Personal Property Tax Bills.

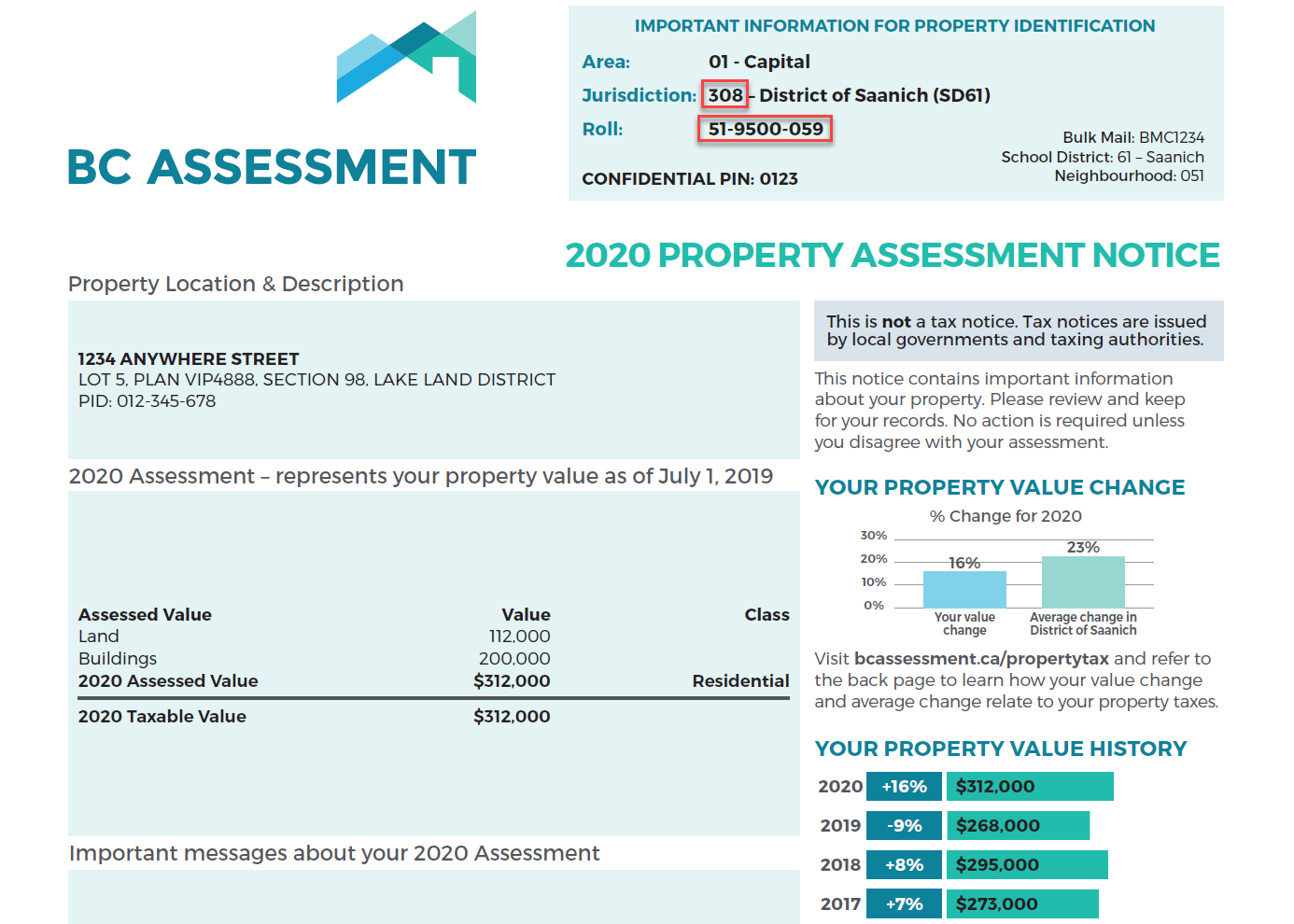

Gross taxes levied. See bill example to know How to Read Your Property Tax Bill. Studying this recap youll get a good understanding of real property taxes in Richmond and what you should be aware of when your propertys appraised value is set.

Several government offices in Richmond and Virginia state maintain Property Records which are a valuable tool for understanding the history of a property finding property. For Real Property direct your call to the Assistant Deputy of Real Estate. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Property Inquiry The report will include. Welcome to the Augusta-Richmond County BOA Office Website The mission of the Richmond County Board of Assessors Office is to provide and defend uniform fair market values on all tangible properties in Richmond County. Documentary Transfer Tax.

Annual Tax notices are sent to property owners in the last week of May. 15-16 Commitment Book Name 15-16 Commitment Book PP. Property Record Cards - This site provides access to detailed assessment data for real estate within the County along with printable property cards.

Do not enter the street suffix ROAD DRIVE etc PlatLot. Monday - Friday 8am - 5pm. Enter the street name only and pick the correct street number from the list.

And to serve as a resource for the. If you do not receive your tax notice by mid June please contact the Tax department at 604-276-4145. Richmond County Board of Education is reducing the property tax rate by 86 to 1765 mills the lowest its been in nearly 20 years officials said Thursday.

Richmond Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Richmond Virginia. Obtain a free uncertified Property Report on any Richmond property.

The Annual Property Operating Data Apod Why Real Estate Investors Use It And How To Construct Real Estate Investing Rental Property Estate Investing Rental Property Management

Fort Bend County Property Tax Protest Fbcad Property Protest Fbcad Property Tax Fbcad Tax Protest Bexar County Property Tax

Chores To Get Done If You Re Stuck At Home Real Estate Curb Appeal Custom Home Builders

Single Family Homes For Sale 4 Homes Zillow Home Tuscan Inspired Waterfront Homes

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Property Management Rental Property

Where Do I Find My Folio Number And Access Code Myrichmond Help

Vacation Rentals Vs Regular Rental Property Rental Property Rental Property Vacation Rental Management Vacation Rental

Clients Ready To Become Homeowners Again Give Them This Free Resource Buying A Home After Bankruptcy Foreclosure Or Short Sale Richm Home Renovation Loan Real Estate Tips Home Buying

Property Assessment Assessment Search Service Frequently Asked Questions

Single Family Homes For Sale 4 Homes Zillow Home Waterfront Homes Guest Bedroom

Rental Income Expense Worksheet Real Estate Investing Rental Property Rental Property Management Rental Income

Access Denied Ridgewood Property Records Street View

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

About Your Tax Bill City Of Richmond Hill

15725 Kings Highway Montross Va 22520 Manufacturing For Sale Loopnet Com Montross Fenced In Yard Property Records